How To Use Compensation Budgeting to Calculate Raises

The compensation philosophy defines how employees are paid, how work is valued, and how the company’s financial resources – the budget - are allocated. The compensation strategy supports this philosophy, defining market competitiveness and position. Based on the compensation philosophy, Finance and Human Resources, along with department leaders and managers, develop an annual payroll budget designed to successfully execute that philosophy and ensure a labor force to support the company’s goals. Effective compensation budgeting requires careful planning and consideration of factors, both internal and external, that impact the labor force. It is one of the most important functions of Finance and Human Resources.

An annual salary review of all jobs, using salary survey data, allows for planning and preparation to make timely financial decisions to keep the labor force competitive. This activity should align with budget preparations. HR professionals utilize salary survey data to conduct salary reviews in order to calculate salary increase percentages and plan future compensation.

The salary review should reveal the following:

- Equity considerations

External – Which salaries are falling behind the pace of the market? Are there hot jobs for which you need to keep pace more aggressively? Is there a trend in turnover rates for certain positions? Where are you losing jobs?

Internal – Identify fair pay issues or adverse impact based on protected categories (i.e., race, gender, ethnicity). Are there compression issues between supervisors and managers and their direct reports? Are there long-term employees being paid less than new hires?

- Position in range or compa-ratio

Use statistical formulas to get a bird’s-eye view of where positions fall in relation to the external market by using compa-ratio and position-in-range calculations. This will show where salaries align to the market, to the internal salary structure, and to others in the position. This data may reveal a need to adjust the ranges.

Use range penetration if the structure includes broad or wide bands/ranges. Go deeper in the range for those with significant experience who are performing well. If range structures are broad, compare market position in range to current/actual position in range.

Does the range midpoint reflect the 50th percentile of market? If so, use compa-ratio to determine if an adjustment is needed. If the compa-ratio is less than 80%, consider moving the salary. Is the incumbent new in the role, with less experience (e.g., less than three years of experience), and still learning the role? In that case, expect to see the incumbent paid at the 25th percentile or somewhere below the market 50th percentile. With three to five years of experience, expect the incumbent to be a competent performer who is fully performing and contributing.

- Structures – If the ranges are increased, bring those below minimum to the new range minimum.

- Any legal or contractual obligations to consider, such as minimum wage updates or labor union contracts?

After the initial salary review, discuss the findings with managers and department leaders. In addition, solicit input regarding promotions, performance, and development of high potential employees. Ask managers to consider where they see their staff over the next year. Do they have key employees who are flight risks? Are there opportunities to develop an employee for possible succession planning? Has HR identified any fair pay, equity, or compression issues that need to be addressed?

Armed with a comprehensive list of salary adjustments needed, as well as anecdotal data from managers regarding impending promotions and performance, HR can calculate the costs associated with pay raises, salary adjustments, and promotions for inclusion in the salary budget. Calculate and communicate compensation budget needs. Summarize the budget requests, then present and submit compensation budget requests to the Finance team.

Calculating Pay Raises

Once the pay inequities and salary adjustments have been identified, the next step is to calculate raises. Many companies use a merit matrix to determine increases based on performance and market comparisons. Compa-ratio compares current salary to the market position of the range midpoint (usually 50th percentile). A compa-ratio of 100% indicates that the salary in question is paid at the market rate that one can expect to pay for fully competent, experienced incumbents. A compa-ratio less than market is appropriate for incumbents still learning, those with relatively few years of experience (perhaps a new college grad), or a new incumbent in the role. A compa-ratio greater than 100% is usually reserved for those employees who are highly experienced, have been in the role for several years, or possess some niche skill set. Determine which ratios need attention, keeping the compensation philosophy in mind. If a ratio is less than 80%, those positions may need an adjustment to align with the competitive market. Calculate the amount needed to bring the salary to the range midpoint, if appropriate. An interim approach would be to gradually adjust, bringing the ratio up in increments.

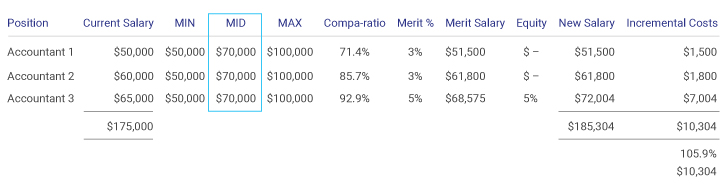

For example:

Accountant 1 is paid $50,000 as a new college grad with no experience.

Accountant 2 is paid $60,000 with 2 years of experience and competent performance.

Accountant 3 earns $65,000 with 7 years of experience and is considered a high potential employee.

Market for the position is $70,000, and the range is $50,000 – $100,000.

The compa-ratio calculation for Accountant 1 is current salary/range midpoint or $50,000/$70,000.

The ratio is 71.4%. At first glance, the ratio may seem rather low. However, given that the incumbent is a new college graduate with no experience who is not fully competent in the role, the ratio is acceptable. Competent performance earns an additional 3% of salary ($1,500) with a new salary of $51,500 and a new compa-ratio of 73.6%.

The compa-ratio for Accountant is 85.7% after 2 years of experience, assuming the incumbent is demonstrating competent performance. With additional experience and continued performance, the incumbent should reach market within a year. Competent performance earns an additional 3% of salary ($1,800) with a new salary of $61,800 and a corresponding compa-ratio of 88.3%.

Accountant 3 has 7 years of experience and is considered a high potential employee, ready for more responsibility and promotion. Outstanding performance earns a 5% merit increase ($3,575) and a compa-ratio of 98%. A 5% equity adjustment is suggested to move the incumbent further in the range, in recognition of experience and performance, positioning to maintain a sense of competitiveness with other organizations. The cost of the equity adjustment is $3,429, with a final salary of $72,004 and a 102.9% compa-ratio.

The total cost for the suggested salary action is $10,304, or 5.9% of current total salaries.

It is important to follow the established review and approval process, making certain to adhere to budget guidelines. (Finance may build in some margin.) Load decisions into the Excel workbook or compensation management system to get the results. Continue to develop solutions for needed salary adjustments. Calculate the costs and compare to the allocated budget. Finance will be interested in the roll up or overall budget impact. Cost out the scenarios identified to fix any issues and determine what you can afford to pay; that is, fix everything at once, fix issues over a period of time, fix critical positions, or make changes to your strategy, philosophy, or policy. Utilize SalaryExpert’s Salary Assessor to help plan and calculate raises and plan future compensation budgets.

Finance, in conjunction with HR, is responsible for determining the overall payroll budget dollars to present to leadership, who may approve the budget request as is or possibly ask for adjustments by a certain percentage to maintain a certain level of expense (say 3% of payroll).

Once finalized and approved, send the plan to department leaders to distribute based on overall guidelines provided to ensure equity and a sense of fairness.