What Is The Difference Between Minimum Wage and Living Wage?

In compensation planning, HR professionals face the challenge of aligning wages with the economic realities that their employees encounter. Two critical benchmarks in this process are the minimum wage and the living wage. Both are integral to creating fair and sustainable compensation structures. In this comprehensive guide, we will delve into the nuances of minimum wage and living wage, exploring their differences, historical trends, and state-level variations.

MINIMUM WAGE VS. LIVING WAGE

Minimum wage serves as the federal or state-mandated floor for compensation. It establishes the lowest hourly wage that an employer can pay their employees on an hourly basis. Minimum wage rates apply to most employees, with some exemptions defined by the Fair Labor Standards Act (FLSA). The objective of the minimum wage is to protect workers from exploitation and ensure that they receive a basic standard of living. Minimum wage differs between countries and not every country has the same laws and regulations. Many U.S. states, counties, and cities have minimum wage rates that exceed the federal minimum, along with local regulations specific to industries or organization sizes.

Over time, the federal minimum wage in the United States has seen periodic increases, but its purchasing power has not always kept pace with the rising cost of living. Since its inception in 1938 under the Fair Labor Standards Act (FLSA), the federal minimum wage has experienced numerous adjustments. The current federal minimum wage is $7.25 per hour, effective July 24, 2009. A key consideration is whether these adjustments have truly mirrored the increasing cost of living. For instance, Washington state currently has the highest state minimum wage at $16.28 per hour, effective January 1, 2024, reflecting rising inflation in Washington.

The living wage, on the other hand, takes a more comprehensive view of the financial requirements for individuals and families to sustain a basic standard of living in a specific geographic area. This includes essential expenses, such as housing, transportation, health care, education, taxes, etc. Standard of living can be defined as the basic material factors, such as income, gross domestic product (GDP), life expectancy, and economic opportunity that defines the quality of life. One way of measuring standard of living is by looking at the Human Development Reports to compare the Human Development Index (HDI) by country. We can see that Switzerland has a HDI value of 0.962, while South Sudan has a HDI value of 0.385. This means that the standard of living in Switzerland is higher than South Sudan, and we can assume that the living wage is also significantly higher. Standard of living is generally higher in more developed countries.

When comparing minimum wage with living wage over time, the living wage has witnessed steady growth. Meanwhile, minimum wage has not always kept up with the rising cost of living. Housing, health care, and education costs have surged, creating a disparity between the minimum wage and the actual expenses that individuals and families face.

MINIMUM WAGE VS. LIVING WAGE BY STATE: RECOGNIZING GEOGRAPHIC DISPARITIES

The United States is a diverse landscape with significant variations in wages from state to state. There are both federal and state minimum wage laws, and local entities, such as cities and counties, that can also enact minimum wage laws. In cases where an employee is subject to multiple minimum wage laws, the employee is entitled to the highest of the minimum wage rates. States without minimum wage laws adhere to the federal minimum wage rate. States and local legislation have their own methodologies when determining rates and can make minimum wage changes at various times. Compensation professionals must be attuned to these geographic disparities to ensure that they adhere to all applicable rules and regulations. SalaryExpert stays on top of those changes by continuously monitoring and tracking federal, state, and local minimum wage changes in the Assessor Platform, powered by ERI.

STATE-LEVEL MINIMUM WAGE VARIATIONS

State governments have the authority to set their own minimum wage rates, often exceeding the federal minimum. Some states, such as California and New York, have implemented higher minimum wages to better align with the elevated cost of living in these regions. For instance, as of January 1, 2024, California’s minimum wage is $16.00 per hour, which is greater than the federal average of $7.25. For example, we know that California has a higher minimum wage average more specifically, 34% higher than the national average to compensate for its elevated cost of living.

STATE-LEVEL WAGE VARIATIONS

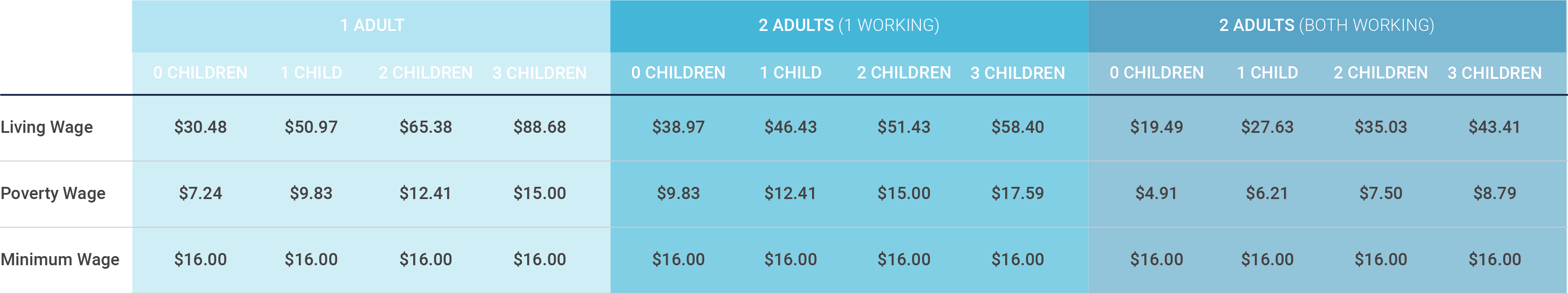

Compensation professionals should also analyze the living wage differences among all applicable geographic locations to determine appropriate wage levels that consider the standard of living in local economic conditions. While compensation structures are generally designed based on the cost of labor, or the supply and demand for labor in a particular industry and geographic location, living wage is often used by compensation professionals to plan relocation allowances, cost-of-living adjustments, remote worker pay, etc., and should remain part of the equation. Compensation professionals should consider both minimum wage and living wage when building a total compensation plan to attract ideal candidates. For instance, the minimum wage for Orange County, California is $16.00 as of February 14, 2024 (note that data on this page will be updated annually in the first quarter of the new year). This prevents an individual from poverty but is not ideal if the living wage is $30.48 for a single adult. In this case, you could provide a higher minimum wage or total rewards, minimizing the wage gap between minimum wage and living wage, and facilitate a higher standard of living.

BENEFITS OF USING THE ASSESSOR PLATFORM

With compensation information backed by ERI's vetted and verified salary survey data, the Assessor Platform can help you benchmark compensation and much more:

- Easily Conduct Salary Analysis and Benchmarking: Gain access to full details of minimum wage regulations in major cities, municipalities, and counties, as well as local and state pay transparency rules. Get current and scheduled minimum wage rate updates for each of the 50 states, the District of Columbia, and all provinces in Canada. Using the interactive map, you can view specific minimum wage rules quickly by location.

- Scenario Modeling: The Assessor Platform allows you to simulate various scenarios, allowing you to assess the impact of different wage adjustments within your workforce and overall budget.

- Compliance Management: Staying compliant with ever-changing labor laws and regulations is crucial. Since minimum wage can vary by city, state, county, and country, ensure you are compliant with labor laws and get alerts when one of your employees drops below the local minimum wage rate.

As compensation professionals, staying current on minimum wage and living wage enables you to design compensation structures that uphold market competitiveness, align with employee needs, and ensure legal compliance. Offering salaries that meet your employee's needs enhances your ability to attract and retain your preferred workforce. Leverage our compensation tools to navigate the complexities of salary benchmarking, ensuring all employees are fairly compensated in relation to the established minimum wage standards. For additional information on minimum wage regulations and how to benchmark pay across specific industries and geographic locations, visit the Assessor Platform, powered by ERI.