Social Security Administration Announces 2024 Payroll Tax Increase

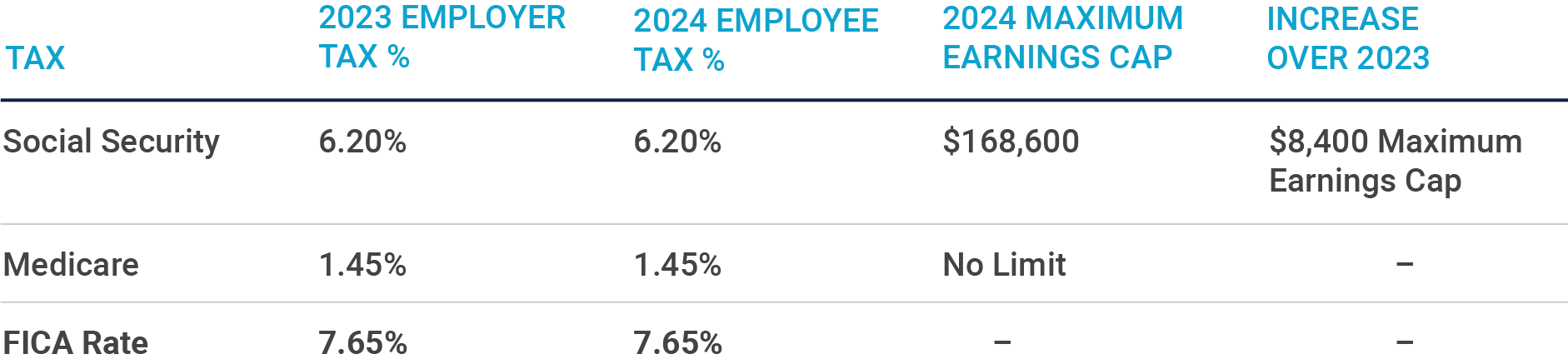

Effective January 1, 2024, the U.S. Social Security Administration will increase the maximum earnings subject to the Social Security payroll tax by $8,400 (from $160,200 in 2023 to $168,600 in 2024).

Note: Additional 0.9% Medicare tax withholding on FICA wages greater than $200,000 ($250,000 for married couples filing jointly) in a calendar year (paid by the employee).

Source: U.S. Social Security Administration

Social Security Fact Sheet

The Internal Revenue Service has announced 2024 retirement plan contribution limits, as well. Learn more about them by looking at our post highlighting the major changes.

About SalaryExpert

SalaryExpert, powered by ERI Economic Research Institute, compiles the best salary, cost-of-living, and executive compensation survey data available. Learn more about new compensation updates and how rule changes may affect business planning at SalaryExpert.