Supplemental Pay Practices: Differentials, Stipends, and One-Time Bonuses

There are many components of a fair, equitable, and market-competitive total rewards program. Supplemental pay practices through differentials, stipends, and even one-time bonuses can be under-estimated in their role in attracting, retaining, and motivating an engaged workforce. In many cases, supplement pay practices are implemented to recognize additional requirements related to a job.

Shift Differentials

With more and more companies running 24/7/365 operations, there are many challenges to attracting, motivating, and retaining employees. Companies recognize these employees by paying a premium to work their more undesirable shifts—typically the second or third shift.

A vast majority of companies pay shift differentials to their hourly-paid employees, where only one out of three salaried employees receive shift differentials. This practice is more common within the technology sector. Hourly employees will typically be paid either of the following:

- A flat amount per hour between $0.50 and $1.25 per hour; or

- A percent of hourly base pay (most frequently 5-15% of hourly rate of pay); and

- Less desirable shifts typically receive the higher differential.

When paid, salaried employees normally receive an additional percentage of pay for working the second and third shifts:

- Typically paid as a percent of salary (5-15%); and

- Less desirable shifts typically receive the higher differential.

Some companies will provide additional time off in lieu of paying the shift differentials.

Lead Differentials

A lead role typically will provide oversight of people, projects, or functions for a business. Where a supervisor will have hiring, termination, and performance management responsibility, the lead does not. A lead may contribute to these processes but typically does not have final, decision-making authority in employment decisions.

It is relatively common to see lead roles being managed at the senior level of a career ladder. Exempt leads tend to be managed through their salary range. Nonexempt lead roles, especially in operational work settings, frequently receive a lead differential of 5-10% of base salary.

SalaryExpert’s Salary Assessor is a great tool for analyzing the pay difference between a lead and non-lead employee.

Pay for Working Holidays

Some industries operate on a 24/7 schedule and, as a result, require employees to work on a federal holiday. This commonly occurs in retail, health care, services, and emergency support. Holiday pay for time not worked is typically not required, and most state laws do not require employers to observe holidays or to pay employees for holiday time off.

Overtime is paid based on hours worked over 40 per week (or the applicable state law, such as California’s law for over 8 hours in a day). Just as with paid leave, it is important to have clear, documented holiday pay policies, since state laws will enforce the written policy.

Companies commonly provide pay at time and a half for working on a holiday. Occasionally, a bonus or paid time off will be provided to recognize employees working on a federal holiday.

Remember, exempt employees, working any portion of a workweek commonly require payment in full for the entire week. It is always recommended to check both federal and state laws.

For an easy way to check if an employee is FLSA exempt, use SalaryExpert’s Occupational Assessor.

Language Pay

A vast majority of companies do not pay additional differentials for knowledge of a second or third language. Companies, though, tend to recognize the skill within the existing salary range.

Occasionally, it may be appropriate to recognize the skill with language pay. In this instance, the criterion needs to be well defined to ensure it applies only to an appropriate, eligible group. Otherwise, the program can be misused. See the following example.

Example: Call Center pays a foreign language premium of 10% of base pay when a second or third language is required to be used 50% or more of the work time on the job.

On-Call Pay

Always check both state and federal laws to determine when nonexempt employees are required to be paid for on-call time. Check to see if your state has its own standards for when employees must be paid for on-call time; many states have their own minimum wage and overtime laws which are separate from those of the federal government. Employers must follow the higher of the two laws—either state or federal.

In addition to on-call pay, consideration needs to be given to standby or waiting time, uncontrolled standby, controlled standby, and response and reporting time.

In addition, supplemental on-call pay for nonexempt employees, especially in a highly competitive marketplace and industry, is provided and administered as a flat amount per day, weekend, week, or holiday for on-call pay. When paid, the supplemental payment can range from $25 to $50 per day (holidays paid at the higher end of the range).

Exempt on-call pay is optional. In a highly competitive labor market and industry, companies will commonly provide exempt on-call pay. When used, companies typically will pay an additional flat amount per week for being on call—where $250 per week is a common rate. Occasionally, a company may design an exempt on-call program based on a daily, weekend, or holiday rate ranging from $75 to $200 per day (holidays paid at the higher end of the range).

Hazard Pay

Hazard pay means additional pay for performing hazardous duty or work involving physical hardship. Work duty that causes extreme physical discomfort and distress which is not adequately alleviated by protective devices is deemed to impose a physical hardship. The Fair Labor Standards Act (FLSA) does not address the subject of hazard pay, except to require that it be included as part of a federal employee’s regular rate of pay in computing the employee’s overtime pay. ¹

Hazard pay is optional and may be built into the overall compensation package or it may be managed as a separate stipend. It is important to consider the compensation strategy of the company and the labor market. It may even be part of a union contract or a strategy for union avoidance.

Hazard pay can be temporarily based on the occurrence or an ongoing premium to pay. It could be managed as a flat amount per hourly rate of pay or managed as a percent of pay. For example, $2.50 an hour for working in a mine; or $2.50 an hour when working in a mine.

In another example, a surveyor received a 20% hazard pay premium only when working out of a helicopter. In a different example, a power plant in Japan raised its hazard pay from $100 a day to $200 a day after the nuclear power accident

The U.S. State Department website is an excellent resource for guidance on danger pay by country. The BLS also publishes a news release on the most dangerous occupations each year.

Nonexempt Travel Time

Under FLSA, “home to work” and “work to home” is typically not considered to be travel time. It is always a good idea to ask, “Is the employee under an employer control or not,” when determining travel time. If the employee is under employer control, the employee is typically eligible for travel pay.

When non-exempt employees travel on company business, they are typically under “control” of their employer until they arrive at their destination, check into a hotel, and then are no longer under “control” once they get to their room and are free to do what they like.

A sample travel time policy pays hourly employees at a dual-rate. Minimum wage is paid for “travel time” in excess of their regularly scheduled hours of work per week rather than the employee’s regular rate of pay. A regular rate of pay is paid for all other work. Under a dual-rate program, nonexempt employees receive their regular rate of pay and then “minimum” wage for travel time for travel hours in excess of their weekly regular rate of pay. Always obtain legal counsel prior to implementation.

Spot Bonuses

Spot bonuses are used to recognize and reward one-time events, such as outstanding performance, perfect attendance, project completion, or other important achievements. Spot bonuses are most commonly used for non-executive employees. Maximum awards are commonly between $1,000 to over $5,000 before taxes and typically not grossed up.

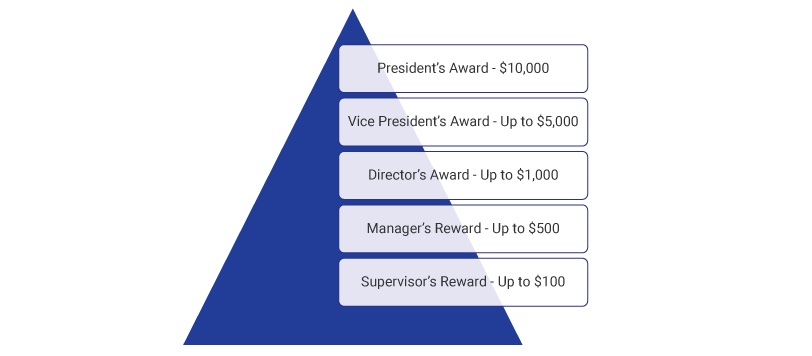

A Tiered Recognition Program, as in the example below, provides different employee reward levels, which can be approved by different levels of management. A program like this can be budgeted and allows for immediate recognition in rewarding and recognizing special employee achievements.

Retention Bonuses

Retention bonuses are commonly used by companies to support a crucial business or production cycle such as an acquisition, divestiture, or a business relocation. The bonus aids in supporting employee retention during a challenging organizational transition. It tends to be tied to an important end date to incent the employee to stay with the company when he or she may be motivated to leave an organization for greater stability.

It is important to avoid overusing retention bonuses. Professional and management employees are commonly eligible, whereas non-exempt employees are not typically eligible.

Retention bonuses are commonly paid out as a lump sum, and most receive the retention bonuses as a flat dollar payment. It is less commonly managed as a percent of pay or paid at management discretion. When calculating retention bonuses, 10-20% of base pay is a typical retention bonus.

A Note about Supplemental Pay Practices

When implementing supplemental pay practices, it is a good idea to include three reviews:

- labor law,

- state and federal eligible time/pay/overtime requirements, and

- state and federal tax withholdings.

Also, supplemental pay practices and bonuses will most likely be subject to an overtime payment calculation for nonexempt employees. Non-discretionary bonuses paid to nonexempt employees need to be accrued for and added to the employee’s “regular compensation” for overtime calculation purposes. This also applies to gift cards and meals provided. If it is promised or expected or a part of a compensation package, then it must be accrued for and becomes overtime-eligible.

Ensure the required tax withholdings are made on the supplemental pay.

Summary

Supplemental pay practices can be managed to complement a fair, equitable, and market-competitive total rewards program. Supplemental pay practices are commonly used to incent an employee to work under difficult conditions, under unique schedules, during a business transition, or even during key holidays. A fair program is important for these business requests and requirements. We suggest that supplemental pay practices be included in your ongoing competitive market review. They perform an important role in attracting, retaining, and motivating an engaged workforce.

ERI Economic Research Institute compiles the most robust salary, cost-of-living, and executive compensation survey data available, with current market data for more than 1,000 industry sectors.

SalaryExpert’s Assessor Series, powered by ERI – Solutions for every compensation decision

References: